Excerpt:

http://www.pbs.org/newshour/bb/business/enron/player9.html

Excerpt:

Chewco is a $383 million investment partnership allegedly arranged by Enron's former chief financial officer Andrew Fastow in 1997 to keep Enron's debt off its balance sheets.

Chewco, named after a Star Wars character Chewbacca, was part of a cluster of partnerships that executed different roles in billion-dollar financing deals. Funded by money invested in Enron and without investor knowledge, the partnership involved Fastow and an off-shore financial group he controlled.

The story of Chewco began nearly a decade ago in 1993 when Enron and the California Public Employees Retirement System (Calpers) created a 50-50 partnership known as the Joint Energy Development Investment Limited (JEDI). At the time, Enron did not include JEDI in its earnings since it did not own more than 50 percent of the partnership.

Then in 1997, Fastow created Chewco which bought Calpers' stake in JEDI. With the purchase, Enron and Fastow essentially owned JEDI. However, since Fastow and his partners had organized Chewco in such a way, the entire partnership was kept off of Enron's books. Since Chewco was not included, the JEDI partnership, still apparently run by Enron and an outside group, also remained off the balance sheet.

http://en.wikipedia.org/wiki/Reed_Hundt

Excerpt:

After leaving the FCC, Hundt has worked as an advisor to McKinsey & Company and to the Blackstone Group.

http://www.sourcewatch.org/index.php?title=Blackstone_Group

Excerpt:

The Blackstone Group is a private investment banking firm and describes itself as a "leading global investment and advisory firm." The Blackstone Group was founded in 1985 by a group of four, including Peter G. Peterson and Stephen A. Schwarzman.

The Blackstone Group has ties to American International Group, Inc. (AIG) and Kissinger Associates, Inc./Henry Kissinger. According to the Blackstone website, AIG acquired a 7% non-voting interest in the company in 1998 for $150 million "and committed to invest $1.2 billion in future Blackstone-sponsored funds".

"Blackstone has developed strategic alliances with some of the largest and most sophisticated international financial institutions. In addition to AIG, they include Kissinger Associates, Roland Berger & Partner, GmbH, and Scandinaviska Enskilda Banken," the website states. [1]

The company's Blackstone Alternative Asset Management unit handles $1 billion in hedge funds for pension giant CalPERS.

John Forbes Kerry 2004 campaign 'adviser' Roger C. Altman was Vice Chairman of The Blackstone Group from 1987 through 1992 "where he led that firm's merger advisory business". [2]

In December 2001, The Blackstone Group was appointed as Enron's principal financial advisor with regard to its financial restructuring.[3] The company also advised Enron on "the Sale of its North American Power and Gas Trading Business to UBS". [4]Template:Deadlink

The Blackstone Group is also handling the restructuring of Global Crossing. [5]

http://money.cnn.com/2001/11/28/companies/enron/

| Dynegy scraps Enron deal | |

| Collapse of $9B deal could push Enron into bankruptcy, analysts say. |

Excerpt:

NEW YORK (CNN/Money) - Dynegy Inc. scrapped its proposed $9 billion merger with Enron Corp. Wednesday, a move that leaves what had been one of the nation's biggest and most influential companies teetering on the edge of bankruptcy.

The collapse of the deal came after Standard & Poor's, one of the nation's leading credit-rating agencies, said it cut Enron's debt to "junk bond" status because of worries that Enron might be forced into bankruptcy - the latest blow to a company that had helped reshape the nation's energy markets by using cutting-edge computer and Internet technology.

http://money.cnn.com/2010/08/13/news/companies/dynegy_shares_surge/index.htm

Excerpt:

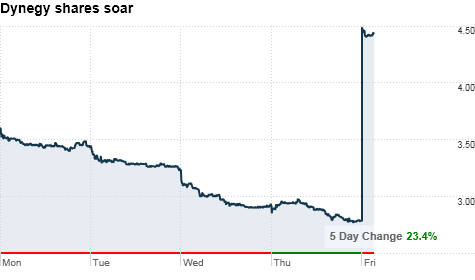

An Enron-era name acquired by Blackstone

NEW YORK (CNNMoney.com) -- Shares of Dynegy Inc. - a power generating company that played a role in the Enron scandal - surged more than 60% Friday after the company agreed to be acquired by investment firm Blackstone Group for $4.7 billion, including its existing debt.

Under the deal with Blackstone Group (BX), Dynegy stockholders will receive $4.50 in cash for each share of Dynegy common stock they own -- a 62% premium to the closing share price of $2.78 on Thursday, the company said.

http://www.sourcewatch.org/index.php?title=Dynegy_/_LS_Power

Excerpt:

Dynegy Inc. (NYSE: DYN), based in Houston, TX, is a large owner and operator of coal, fuel oil, and natural gas power plants.[2] The company's portfolio consists of 31 power generation facilities producing approximately 20,000 megawatts of power in the Western, Midwestern, and Northeastern United States.[3]

Once known as "The Natural Gas Clearinghouse," Dynegy adopted the "New Economy" branding in 1998, after which the company structured itself in a manner similar to Enron, launching several business ventures, including an online trading platform and broadband communications services, which could be misconstrued of those of its larger rival.

In March 2007, Dynegy acquired LS Power, a privately-held coal and gas power developer, to form the largest builder of coal plants in the country.[4][5] LS Power received 340 million shares of Dynegy common stock, $100 million in cash, and a $275 million note. Dynegy assumed approximately $1.8 billion in debt from LS Power.[4]

http://www.lspower.com/News/newsArticle071608.htm

Excerpt:

Scott Healy, Senior Vice President.

Mr. Healy has over 17 years experience in power generation development and finance, including the successful development or financing of over 4,500 MW of gas fired generation projects and over 2,000 MW of wind generation projects. Prior to LS Power, Mr. Healy held senior management roles at Kenetech, Calpine, Enron, PPM Energy, Orion Energy and Orion Energy Group.

http://www.electricityforum.com/news/aug03/scandal.html

Excerpt:

Two ex-Dynegy execs plead guilty in fraud scheme

HOUSTON -- Two former executives of energy company Dynegy Inc. have pleaded guilty to criminal charges stemming from a 2001 scheme to falsely boost profits in a case reminiscent of the deals that brought down Enron Corp. Gene Shannon Foster, Dynegy's former tax vice president, and Helen Christine Sharkey, the company's former accounting manager, each pleaded guilty to one count of conspiracy to commit securities fraud, reversing their earlier pleas.

"They made what was actually red ink appear to be black," U.S. Attorney Michael Shelby told reporters after the hearing before U.S. District Judge Sim Lake.

http://www.nytimes.com/2003/06/13/business/former-employees-of-dynegy-face-charges-of-fraud.html

Excerpt:

Former Employees Of Dynegy Face Charges of Fraud

Federal prosecutors charged three former employees of Dynegy, the large energy trader, with securities fraud and conspiracy today in connection with their role in a secretive project aimed at disguising a $300 million loan as cash flow.

The indictment against the three defendants, all midlevel employees at Dynegy, once a highflying rival of Enron and the El Paso Corporation, two other Houston-based energy trading companies, is part of a continuing investigation of Dynegy, whose founder, Charles L. Watson, resigned as chief executive in May 2002.

Dynegy released a statement today saying that it ''has been and remains committed to complete cooperation with the U.S. Attorney's Office in Houston and other government agencies.''

The six-count indictment of the three defendants, Jamie Olis, 37, a former senior director of tax planning; Gene Shannon Foster, 44, a former vice president for taxation; and Helen Christine Sharkey, 31, a former member of Dynegy's risk control and deal structure groups, also included charges of mail fraud and three counts of wire fraud.

Excerpt:

Former Dynegy executive jailed for 24 years after $300m fraud

Tax specialist Jamie Olis was convicted in November for his part in an accounting fraud designed to hide $300m in debt from Wall Street and report inflated operating results.

Mr Olis, 38, will not be eligible for parole, which means he will serve almost his entire sentence.

Mr Olis, 38, will not be eligible for parole, which means he will serve almost his entire sentence.

http://www.freakonomics.com/2006/09/11/creative-uses-of-efficient-markets/

Excerpt:

There is an interesting article in the Economist showing how this logic landed a guy named Jamie Olis in jail.

http://www.economist.com/node/7880472?story_id=7880472

Excerpt:

Dismal science, dismal sentence

The efficient markets hypothesis can land you in jail

Sep 7th 2006 | from the print edition

http://www.kycbs.net/Dynegy.htm

Excerpt:

November 3, 2006

Corruption - A $6 Million Gift

To Oil Company

To Oil Company

In years past this alone would have been a major story and the corruption involved would not be tolerated. But this year it's just one more thing - a relatively small thing. We all know what is behind it - payments from lobbyists. The people involved will be leaving the government soon to "work" at the oil companies for unusually high pay. Gov't drops demand for Chevron royalty,

The department's Minerals Management Service had maintained that Chevron owed an additional $6 million for gas it took under federal leases in the Gulf between 1996 and 2002 and sold to Dynegy Inc., a company Chevron partially owns.

Essentially, the government argued that Chevron undervalued the gas it sold to Dynegy. Chevron paid royalties based on a price that didn't represent fair market value, the government auditors said.

http://en.wikipedia.org/wiki/Chevron_Corporation

Excerpt:

In January 1996, NGC (formerly NYSE: NGL) and Chevron announced plans to merge Chevron’s natural gas and natural gas liquids business with NGC. On May 23, 1996, the companies reached an agreement in principle to merge their business. Under the agreement, Chevron transferred its natural gas gathering, operating and marketing operation to NGC in exchange for a roughly 25 percent equity stake in NGC. On August 30, shareholders approved the deal creating North America’s largest natural gas and gas liquids wholesaler. In 1998, NGC Corporation was renamed Dynegy (NYSE: DYN).[9][10]

In a merger completed February 1, 2000, Illinova Corp. (formerly NYSE: ILN) became a wholly owned subsidiary of Dynegy Inc., in which Chevron also took a 28% stake.[11] However, Chevron in May 2007 sold its roughly 12 percent (at the time) Class A common stock in the company for approximately $985 million, resulting in a gain of $680 million.[12][13]

http://www.offthekuff.com/mt/archives/003069.html

Excerpt:

http://en.wikipedia.org/wiki/Chevron_Corporation

Excerpt:

In January 1996, NGC (formerly NYSE: NGL) and Chevron announced plans to merge Chevron’s natural gas and natural gas liquids business with NGC. On May 23, 1996, the companies reached an agreement in principle to merge their business. Under the agreement, Chevron transferred its natural gas gathering, operating and marketing operation to NGC in exchange for a roughly 25 percent equity stake in NGC. On August 30, shareholders approved the deal creating North America’s largest natural gas and gas liquids wholesaler. In 1998, NGC Corporation was renamed Dynegy (NYSE: DYN).[9][10]

In a merger completed February 1, 2000, Illinova Corp. (formerly NYSE: ILN) became a wholly owned subsidiary of Dynegy Inc., in which Chevron also took a 28% stake.[11] However, Chevron in May 2007 sold its roughly 12 percent (at the time) Class A common stock in the company for approximately $985 million, resulting in a gain of $680 million.[12][13]

http://www.offthekuff.com/mt/archives/003069.html

Excerpt:

February 25, 2004

Chevron buys Enron building ChevronTexaco will buy that grand monument of riches-to-rags excess, the new Enron building. They'll move some 500 non-Houstonians (from New Orleans, Midland, and San Ramon) into it, as well as employees from their other downtown locations.

http://www.dailymarkets.com/economy/2010/12/19/carl-icahns-dynegy-power-struggle-and-coming-showdown-at-chesapeak-energy/

Excerpt:

Diverging Forward Views

For the past few months, Dynegy has been telling investors to accept a buyout offer from Blackstone Group or the company would face dire consequences. However, Dynegy’s investors have a drastic different view about the company’s future.

Billionaire financier Carl Icahn and hedge fund Seneca Capital, two biggest stakeholders of Dynegy, had rejected Blackstone’s original offer of $603 million or $4.50 a share citing gross undervaluation, and that the company is very well positioned to reap benefits of a recovery in electricity price.

Icahn Deal at 10% Premium

The climax came on Wed. Dec. 15, when Dynegy said it accepted a buyout offer of $665 million, excluding debt, from Carl Icahn, while Blackstone Group signaled that the private-equity firm won’t seek to top Icahn’s offer. The offer from Icahn Enterprises, valued at round $5.50 a share, represents a 10% premium to Dynegy’s average closing price over the past 30 trading days.

http://topics.nytimes.com/top/reference/timestopics/people/l/william_s_lerach/index.html

Excerpt:

William S. Lerach

Robin Hood or Legal Hood?'' was the headline of a 2005 New York Times article about William S. Lerach and Melvin I. Weiss, partners at the law firm of Milberg, Weiss.

Mr. Lerach in particular had become perhaps the lawyer most feared and loathed in boardrooms across America. He was a hyperaggressive specialist in filing class action suits against major corporations, supposedly on behalf of small investors who had lost money when a stock's price dropped. The firm was usually the first to file the suits, often giving it the position a lead counsel in the actions and allowing it to collect the majority of the legal fees awarded.

http://en.wikipedia.org/wiki/MCI_Inc.

Excerpt:

Founded in 1963, it grew to be the second-largest long-distance provider in the U.S. It was purchased by WorldCom in 1998 and became MCI WorldCom, with the name afterwards being shortened to WorldCom in 2000. WorldCom's financial scandals and bankruptcy led that company to change its name in 2003 to MCI. The MCI name disappeared in January 2006 after the company was bought by Verizon. As of May 2011 the MCI trademark is still maintained on MCI.com and on a sub-page of Verizon.com.

http://en.wikipedia.org/wiki/UUNET

Excerpt:

Timeline

http://news.cnet.com/MCI-WorldCom-AOL-merger-a-boon-for-business/2100-1033_3-235580.html

Excerpt:

http://www.dailymarkets.com/economy/2010/12/19/carl-icahns-dynegy-power-struggle-and-coming-showdown-at-chesapeak-energy/

Excerpt:

Diverging Forward Views

For the past few months, Dynegy has been telling investors to accept a buyout offer from Blackstone Group or the company would face dire consequences. However, Dynegy’s investors have a drastic different view about the company’s future.

Billionaire financier Carl Icahn and hedge fund Seneca Capital, two biggest stakeholders of Dynegy, had rejected Blackstone’s original offer of $603 million or $4.50 a share citing gross undervaluation, and that the company is very well positioned to reap benefits of a recovery in electricity price.

Icahn Deal at 10% Premium

The climax came on Wed. Dec. 15, when Dynegy said it accepted a buyout offer of $665 million, excluding debt, from Carl Icahn, while Blackstone Group signaled that the private-equity firm won’t seek to top Icahn’s offer. The offer from Icahn Enterprises, valued at round $5.50 a share, represents a 10% premium to Dynegy’s average closing price over the past 30 trading days.

http://topics.nytimes.com/top/reference/timestopics/people/l/william_s_lerach/index.html

Excerpt:

William S. Lerach

Pat Sullivan/Associated Press

Robin Hood or Legal Hood?'' was the headline of a 2005 New York Times article about William S. Lerach and Melvin I. Weiss, partners at the law firm of Milberg, Weiss.

Mr. Lerach in particular had become perhaps the lawyer most feared and loathed in boardrooms across America. He was a hyperaggressive specialist in filing class action suits against major corporations, supposedly on behalf of small investors who had lost money when a stock's price dropped. The firm was usually the first to file the suits, often giving it the position a lead counsel in the actions and allowing it to collect the majority of the legal fees awarded.

http://en.wikipedia.org/wiki/MCI_Inc.

Excerpt:

Founded in 1963, it grew to be the second-largest long-distance provider in the U.S. It was purchased by WorldCom in 1998 and became MCI WorldCom, with the name afterwards being shortened to WorldCom in 2000. WorldCom's financial scandals and bankruptcy led that company to change its name in 2003 to MCI. The MCI name disappeared in January 2006 after the company was bought by Verizon. As of May 2011 the MCI trademark is still maintained on MCI.com and on a sub-page of Verizon.com.

http://en.wikipedia.org/wiki/UUNET

Excerpt:

Timeline

- 1987 - UUNET Communications Services is founded and passes its first traffic via the CompuServe Network on May 12 using UUCP (Unix to Unix Copy Protocol).

- 1989 - UUNET becomes a for-profit corporation

- 1990 - UUNET launches AlterNet

- 1991 - UUNET participates in the founding of the Commercial Internet Exchange Association

- 1994 - Microsoft paid $16.4 million for a 15 percent share of the company

- 1995 - In May, UUNET is listed on the NASDAQ stock market in an initial public offering that would become part of the beginning of the dot-com boom.

- 1995 - UUNET Technologies Inc places a takeover bid against Unipalm Pipex.[6]

- 1996 - UUNET Technologies agreed to a merger with the Microsoft backed MSF Communications Company.[7]

- 1996 - Metropolitan Fiber Systems (MFS) acquires UUNET for $2 Billion

- 1996 - WorldCom acquires MFS on New Year's Eve - Dec. 31st at 11:58 p.m EST for $12.4 billion

- 1997 - Usenet death penalty (UDP) issued against UUNET, and lifted a week later

- 1997 - On November 10, WorldCom and MCI announced their US$37 billion merger including combining internetMCI & UUNET Internet operations.

- 1998 - The combined MCI WorldCom opens for business on September 15 after being given the go-ahead from the DOJ, subsequent to divesting internetMCI.[8]

- 1998 - WorldCom acquires CompuServe Network Services from H&R Block and ANS Communications from AOL. Both become part of UUNET in 1999.

- 1999 - On October 5, MCI Worldcom announces its intentions to buy Sprint for $129 billion.

- 2000 - The European Commission and DOJ denied the MCI WorldCom / Sprint merger on Anti-Trust Grounds.

- 2000 - The UUNET brand is folded into WorldCom's product line and disappears

- 2003 - The UUNET brand re-emerges as WorldCom's wholesale-only brand

- 2004 - WorldCom renames itself to MCI, still using the UUNET brand for wholesale business.

- 2005 - MCI again drops the UUNET brand for wholesale business. The name is no longer in use.

- 2006 - Verizon acquires MCI, including its UUNET subsidiary, now known as Verizon Business. AS701 remains the backbone of Verizon Business although its origin dates back to 1990 when it was under the UUNET flag.

Excerpt:

The planned merger between Time Warner and America Online will benefit MCI WorldCom as the telecommunications firm carries most of AOL's data traffic, chief executive Bernie Ebbers said today. In a speech to the Press Club in Washington, D.C., Ebbers said he welcomed the

The planned merger between Time Warner and America Online will benefit MCI WorldCom as the telecommunications firm carries most of AOL's data traffic, chief executive Bernie Ebbers said today. In a speech to the Press Club in Washington, D.C., Ebbers said he welcomed the

No comments:

Post a Comment